Where is the Korean cosmetics industry headed?

Since the 2010s, the global cosmetics market has been seeing steady growth. There were new demands and changes, but most of them were predictable and intentional. Now, however, the cosmetics industry and markets are now facing more unpredictable changes and uncertainties than ever before. In a way, 2022 is the starting point of such unpredictability. The need for the scientification of cosmetics, and the demand for stronger social responsibility, ethics, and evidence-centeredness, were predictable and intentional, whereas COVID-19, Russia's invasion of Ukraine, and the economic recession are unexpected factors that triggered the recent shift and dilemma in the cosmetics industry.

The Korean cosmetics industry in 2022 is facing transitions and challenges in an ever-changing, complex environment, with some factors that are contributing to this being as follows.

First is ESG, which is being talked about not just in the cosmetics industry but across all industries. ESG reflects the consumer trend that calls for social responsibility and ethics on the part of corporations. It demonstrates how consumption has evolved from being driven by products to being driven by the images and roles that brands take on. In other words, consumers nowadays are interested in not only the products themselves, but also the companies that produce them.

Second is the emergence of generation MZ. Gen MZ have become the new leaders of consumption, bringing with them changes in how products are designed and consumed. In particular, MZers’ tendency to endorse value consumption pressures companies to strengthen their ESG game. Clean beauty and vegan beauty are also a part of this value-centric movement.

Third are the changes in distribution brought on by a stronger emphasis on e-commerce. These changes spring from various factors, most prominent of which is the pandemic, of course. The demand for contact-free interactions has led to changes in distribution, which were readily accepted by consumers, with many of them now being here to stay.

Next is the demand for the scientification of cosmetics and the tendency to prefer new types of cosmetics. Consumers nowadays want to see evidence-based results, such as skin mechanisms, and are interested in functional derma cosmetics. The emergence of subscription or customized cosmetics is also noteworthy. Active integration with other industries stands out more than anything. This has given rise to products that incorporate digital transformation and IT technologies.

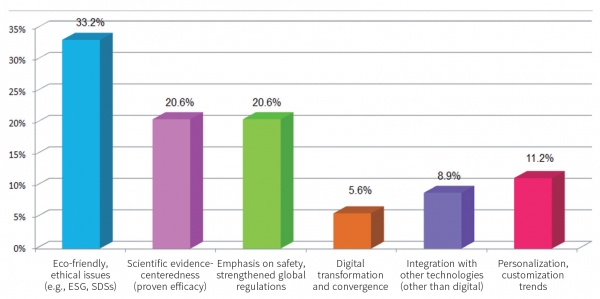

The research conducted by National Center for cosmetics R&D confirms these changes. In a survey taken by cosmetics researchers on the issues that they consider as being the most important and requiring urgent attention in the Korean cosmetics industry, many addressed the need to focus on eco-friendliness, ethical issues, and scientific evidence-centeredness. Translated in numbers, 33.2% answered eco-friendliness and ethical issues (e.g., ESG, SDSs) as the issues that they consider to be most important to Korea and that require the greatest amount of attention, followed by scientific evidence-centeredness (proving efficacy) and emphasis on safety and strengthened global regulations, both at 20.6%, with personalization and customization trends accounting for 11.2%.

Of the many different factors, the biggest and most notable in 2022 were China and exports. The ‘China risk,’ combined with the stagnation of the global economy, led to a contraction in exports, which had driven the growth of the Korean cosmetics industry. Some had predicted that the approaching end of the pandemic would breathe life into contracted exports, but their predictions missed the mark when the pandemic persisted and Russia invaded Ukraine.

Scientific evidence-centeredness is the new direction of the global cosmetics industry.

We need to develop one-of-a-kind materials based on our skin science research and development.

Such findings can lead to the premiumization of cosmetics and renewed global strategies.

We should also consider creating products and services that deliver functions that go beyond their original benefits.

The biggest concerns and interests, at least in the early months of 2023, are the following: when will the endemic finally come, when will the global economy recover, and when will exports regain strength despite the China risk? The situation we are facing right now does not look too hopeful, with KOTRA forecasting exports to contract in its ‘2023 Export Forecast and Market Conditions by Region’ report.

What the Korean cosmetics industry needs is a way out in this battle for survival. In a way, the current crisis gives an opportunity to see the reality to find a resolution. The rapid growth in the past may have led us to overlook our foundations. Now is the time to face the reality and reinforce the groundwork for a better tomorrow.

Here are a few suggestions I would like to make for a way out of this crisis.

First, we need to free ourselves of the fantasy painted by K-beauty and build a scientific foundation. With scientific evidence-centeredness becoming the new direction for the global cosmetics industry, we need to develop unique, one-of-a-kind materials based on research and development in the field of skin science. The findings of such research can lead to the premiumization of cosmetics and renewed global strategies.

Second, we need to combine ideas and technologies to produce ‘Korea-exclusive’ products, like BB cream, air cushion, and face masks, which once pioneered the globalization of Korean cosmetics. A potential successor could be dermacosmetics. Dermacosmetics can be the catalyst that will drive the expansion of cosmetics into the realm of health moving beyond beauty. Korea’s functional cosmetics system, in particular, already has the ability to develop products that boast of various effects. Leveraging such a competitive advantage could earn us a position ahead of our competitors in the global market.

Another way to deal with the crisis is convergence. We need convergence that is not obvious, and that can lead to the birth of products and services that go beyond what the existing cosmetics can deliver. An example would be cosmetics that have an entirely new feature, like the smartphone. Smartphones are used for their additional IT-integrated features, such as photos, videos, and the Internet, more so than they are used for their original purpose: making phone calls. As such, we should consider developing cosmetics products or services that surpass the existing boundary to offer additional benefits.

Lastly, we need to find new markets. This is not limited to a simple increase in the number of regions we export our products to; rather, we need a strategic approach. We can begin this by analyzing the size of the cosmetics markets in export countries and their growth trend and potential, as well as by researching import markets. The import market analysis should entail the size of imports, the percentage they account for in Korea’s exports, and the percentage accountable by Korea in the imports market of the corresponding country, in addition to an analysis of competing countries. The reason newspapers and market research companies focus on the Japanese and the North American market is their relatively larger export growth potential based on their market size and the size of their imports.

The global economic stagnation and the China risk are both force majeure. What the Korean cosmetics industry should concentrate on in 2023 are designing a roadmap to overcome the current crisis and getting ourselves ready diligently. How well we prepare ourselves will decide if the Korean cosmetics industry will succeed in the future.